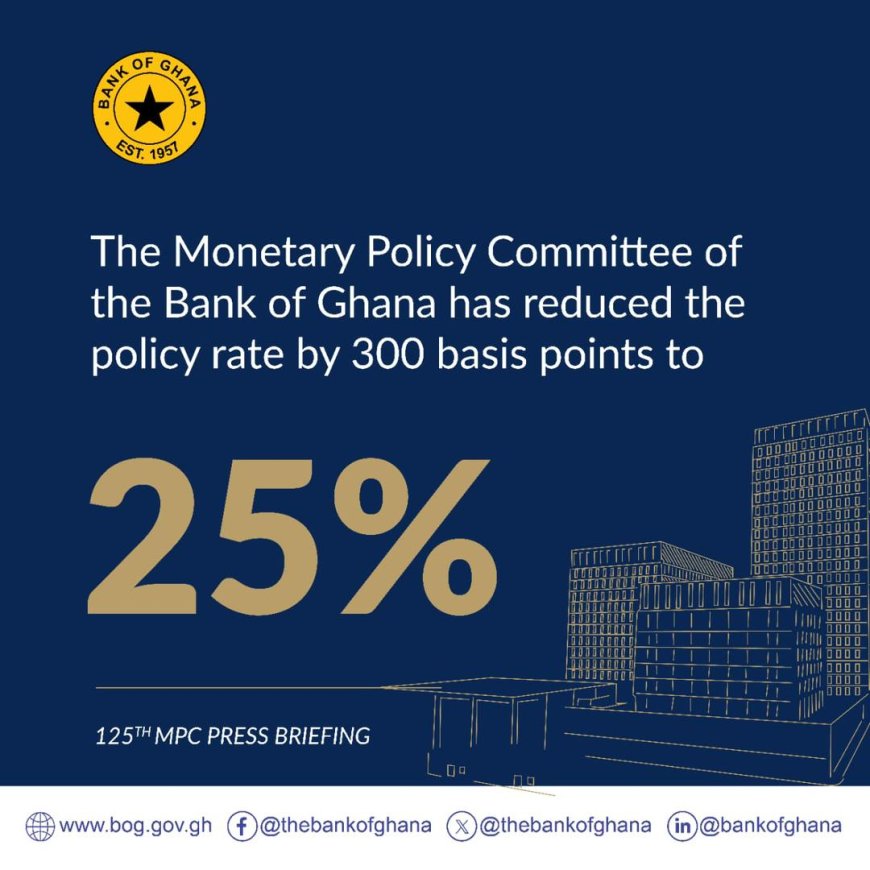

Ghana Central Bank Slashes Policy Rate by 300 Basis Points Amid Strong Economic Recovery

The Bank of Ghana (BoG) has announced a significant reduction in its key interest rate, citing a rapidly improving domestic economy, falling inflation, and robust external sector performance.

Following its 125th Monetary Policy Committee (MPC) meeting, the central bank cut the Monetary Policy Rate (MPR) by 300 basis points, lowering it from 28.0% to 25.0%. This decisive move marks a major shift, reflecting growing confidence in Ghana's economic stabilization.

Key Drivers Behind the Decision:

1. Tumbling Inflation: Headline inflation has plummeted to 13.7% in June 2025, down sharply from 18.4% in May and marking the lowest rate since December 2021. The MPC attributed this decline to its previous tight monetary policy, government fiscal consolidation efforts, easing food supply issues, and a resurgent Ghana Cedi. Core inflation (excluding energy and utilities) also fell markedly, and inflation expectations among businesses, consumers, and banks are now "broadly anchored."

2. Robust Economic Growth: The economy expanded by 5.3% year-on-year in Q1 2025, up from 4.9% in Q1 2024, driven by agriculture and services. Excluding oil, growth was an even stronger 6.8%. High-frequency indicators show sustained economic momentum beyond Q1, with the Composite Index of Economic Activity (CIEA) growing 4.4% year-on-year in May. Business and consumer confidence surveys also show marked improvement.

3. Strengthening Fiscal Position: The government significantly outperformed its fiscal deficit target for the first half of 2025, recording a deficit of just 0.7% of GDP compared to the budgeted 1.8%. This fiscal discipline, coupled with a stronger Cedi and reduced borrowing, has dramatically lowered public debt from 61.8% of GDP at end-2024 to 43.8% by the end of June 2025.

4. Record External Sector Surplus: Ghana achieved a historic current account surplus of US$3.4 billion in H1 2025, fueled by high gold and cocoa prices and increased production volumes. This, combined with positive capital and financial account flows, resulted in an overall balance of payments surplus of US$2.2 billion. Gross International Reserves surged to US$11.1 billion (4.8 months of import cover), up from US$8.9 billion at end-2024.

5. Cedi Resurgence: The Ghana Cedi has staged a remarkable recovery, appreciating 40.7% against the US Dollar, 31.2% against the British Pound, and 24.2% against the Euro since the start of 2025. This strength is underpinned by the strong external balances and reserve accumulation.

6. Banking Sector Stability: Financial Soundness Indicators showed continued improvement in asset growth, solvency, liquidity, profitability, and efficiency across the banking sector in the first half of the year.

Outlook and Risks:

The MPC forecasts headline inflation to decline further in Q3 2025 and trend within the medium-term target band of 8% ± 2% by the end of the year – earlier than initially projected. However, the Committee acknowledged upside risks, including potential global supply chain disruptions from trade tensions and possible upward adjustments in utility tariffs. They expect these risks to be contained by maintaining an "appropriately tight" monetary stance and ongoing fiscal consolidation.

Forward Guidance The MPC signalled its willingness to reduce rates further if the disinflation trend continues. "Looking ahead, the Committee will continue to assess incoming data and likely reduce the policy rate further, should the disinflation trend continue," the statement read. The Committee reiterated its commitment to price stability while fostering conditions for "inclusive and sustainable growth."

The MPC signalled its willingness to reduce rates further if the disinflation trend continues. "Looking ahead, the Committee will continue to assess incoming data and likely reduce the policy rate further, should the disinflation trend continue," the statement read. The Committee reiterated its commitment to price stability while fostering conditions for "inclusive and sustainable growth."

The next MPC meeting is scheduled for September 15-17, 2025.

Source: Nana Esi Brew Monney

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Space FM.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0